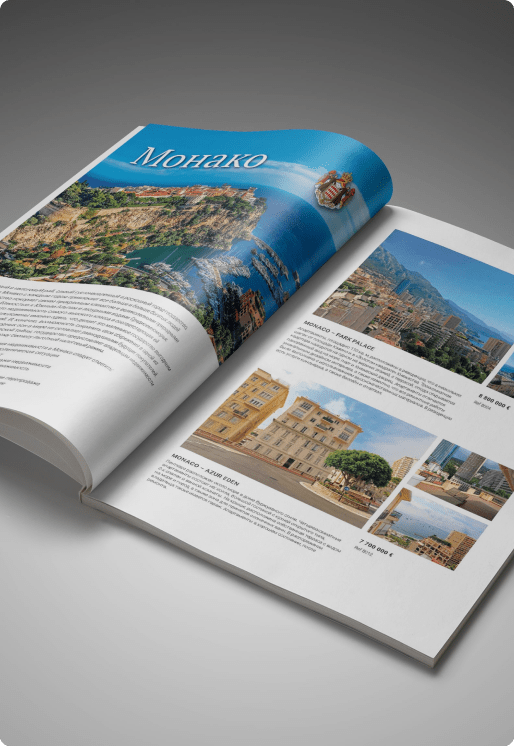

Mortgage lending in Monaco

Luxury housing in Monaco has traditionally attracted discerning buyers from all over the world. Banks in Monaco offer flexible lending conditions, often offering tailor-made solutions for clients wishing to buy property in or outside of Monaco. You can buy real estate in the name of an individual or a legal entity, such as an SCI.

Typically, the term loan varies from 5 to 15 years, and mortgage and financing terms depend on the type of loan, the value of the property and the attractiveness of the client to the bank. Deposit is about 50% of the value of the property to be purchased.

The decision to grant credit is taken after a preliminary study of the client file. In the first place, he must pass the compliance control. Banks in Monaco are very sensitive to their own reputation, so before opening an account, they thoroughly study the files and documents of the clients.

The minimum amount for opening an account in Monaco, starting from an average of 500 thousand euros.

The procedure for obtaining a mortgage loan

To obtain a loan to purchase real estate in Monaco all documents must be submitted in the original and translated by an official translator. The bank considers the documents of the client on average 2 - 3 weeks.

The main types of credit rates:

- A mortgage loan with a fixed bank interest rate for the entire repayment period (prêt à taux fixe) ranges from 2.5% to 3.5%. The main advantage of this rate is reliability: the amount of monthly payments and the total cost of the loan are known from the outset. Regardless of market trends, the rate and term of the loan will not change. A fixed rate can only be changed when refinancing a loan.

- A loan with a floating interest rate (prêt à taux révisable) ranges from 1.3% to 2%. The interest rate is tied to the average Euribor - Euro Interbank Offered Rate, which can change every 3 to 6 months. Floating mortgage rates at first glance look more attractive than fixed interest rates offered by banks. The disadvantage is that it is difficult to predict market interest rates over the long term because of the fluctuations in the market. One limiting mechanism is the "taux capé" clause in the contract, which allows the floating rate to vary within fixed limits of ±1 or 2%.

- A loan with a mixed interest rate (fixed and floating). The principle of this loan allows you to take advantage of a low fixed rate for the first 7-10 years. Generally, a mixed-rate loan is less expensive than a fixed-rate loan for the same period.

Example of repayment schedule for a 15-year loan

Repayable loan

In Fine loan

In Fine loan

Additional costs

Additional costs include the bank's administrative fees of about 0.25% to 0.5% of the amount borrowed. Also, banks in Monaco may request an appraisal of the property to be purchased before making a final lending decision. The cost of the appraisal varies from €1,000 to €5,000 depending on the property and the appraisal company. Notary fees of around 1% should also be added when registering with the mortgage office.

Loan conditions for the borrower:

- Age up to 75 years old;

- Pre-opened bank account in Monaco;

- repayment must not exceed 33% of the monthly income of the borrower.

- This threshold is called "le reste à vivre" - the balance to cover the costs of daily living.

List of documents

Civil Status:

- Internal passport;

- Foreign passport;

- marriage certificate;

- birth certificate;

- proof of residence (receipt of electricity, gas, telephone, water).

Professional activities:

- Three most recent bank statements;

- if there are current loans - tables of amortization of loans;

- if there is rental income a real estate income statement.

Taxation:

Income declarations for the last two years + a certificate from the tax office about the payment of taxes for the same periods;

If you are a shareholder of the company - 3 last annual balances, if you are an employee - certificate of employment and 3 last 3 receipts of salary.

Property status:

- Preliminary real estate purchase agreement;

- Property appraisal certified by a notary or lawyer.

Information for 2018