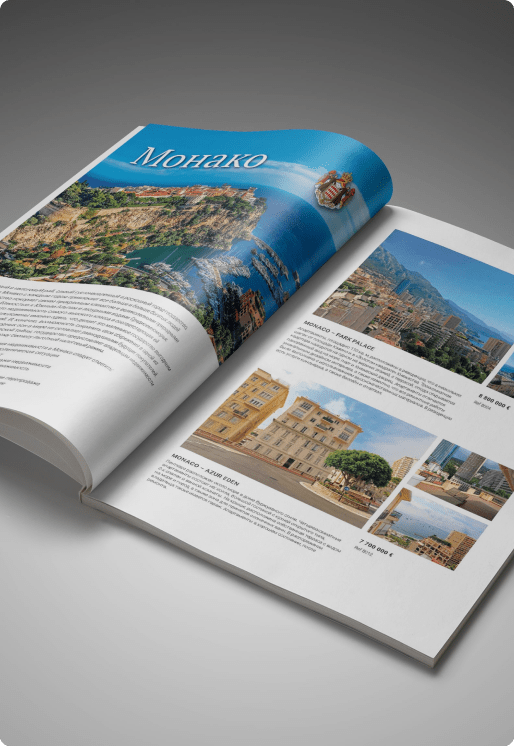

Monaco, nestled on the French Riviera, stands as the world’s most renowned tax haven. Its unique tax regime has positioned the principality as the globe's most distinguished jurisdiction.

Individual Income Tax

Since Prince Charles III’s decree in 1869, Monaco has abolished personal income tax for its residents. Consequently, those residing in Monaco are exempt from paying any form of income, luxury, or capital taxes within the principality.

However, French citizens residing in Monaco are an exception. Their taxation is dictated by a specific agreement, requiring them to pay income tax at a progressive rate from 0 to 45%, similar to residents of France, with the collected taxes directed to the French treasury.

Dividend Taxation

In general, Monaco residents do not pay taxes on any form of income, including both interest earned from abroad and interest paid to foreign entities.

Inheritance and Gift Tax

In Monaco, inheritance and gift taxes are levied only if the property in question is located within the principality, irrespective of the deceased or donor's nationality. This tax also applies to shares, company equity, bonds, intellectual property, etc., if the deceased was a permanent resident of Monaco at the time of their death.

A person is deemed a permanent resident after legally residing in Monaco for six months.

The tax rates for inheritance and gifts vary according to the familial relationship between the deceased (or donor) and the beneficiary.

- Parents and children: spouses - 0%

- Siblings - 8%

- Uncles/Aunts and Nephews/Nieces - 10%

- Other relatives - 13%

- Non-relatives - 16%

Corporate Profit Tax

Monaco offers a tax exemption on corporate profits derived from business activities within its borders, provided that at least 75% of the company’s turnover originates from local operations. This essentially frees companies from taxes, VAT being the exception. Should a company’s turnover from outside Monaco exceed 25%, a tax rate of 33.33% is applied.

Monaco incentivizes certain types of businesses, including startups, with tax benefits. These include:

- Complete exemption from corporate income tax for the first two years.

- In the third year, tax is based on 25% of profits.

- In the fourth year, it rises to 50% of profits.

- In the fifth year, 75% of profits are taxable.

- By the sixth year, profits are fully taxable.

All commercial entities in Monaco, irrespective of their structure, must pay corporate income tax if their activities include earning royalties from intellectual property rights such as patents, trademarks, and copyrights.

Registration Fees

Transactions within Monaco or involving Monaco-based properties require mandatory registration, attracting significant duty fees. The duty on property sales is 4.5% for residential and 7.5% for commercial properties, excluding a notary fee of about 2% of the property’s market value.

Lease agreements must be registered within three months of signing, with a registration tax on rent set at 1% of the total annual rent, VAT excluded. Standard lease terms are typically one year.

Value-Added Tax (VAT)

As of January 1, 2014, VAT rates in Monaco (mirroring those in France) are as follows:

- A standard rate of 20% applies to most transactions.

- A reduced rate of 10% is applicable to agricultural products, transportation, restaurant services, and home repairs.

- A further reduced rate of 5.5% applies to food products, event tickets, books, art, and goods for people with disabilities.

- The lowest rate of 2.1% is reserved for new performances and certain medications and live animals.

Conclusions

Monaco’s taxation framework is distinctively characterized by the near absence of direct taxes, supplemented by indirect taxes on real estate transactions.

Moreover, Monaco’s international residents should be aware that the Principality has limited double taxation agreements with traditional tax jurisdictions due to the non-existence of income tax for principality residents.